Contact Information

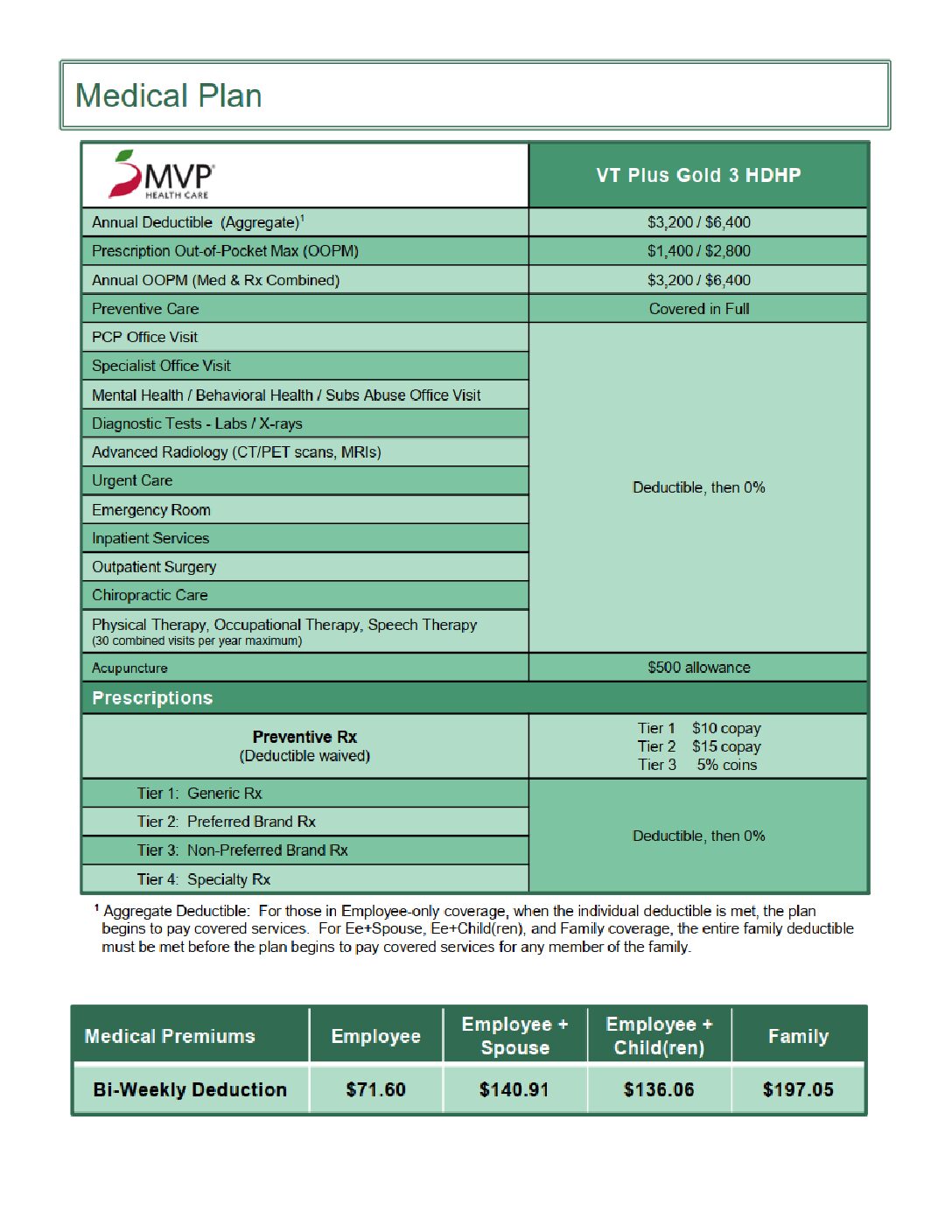

MVP Healthcare

Member Services: (800) 229-5851

Plan Provider Directory

https://www.mvphealthcare.com/members/find-a-doctor

Forms and Plan Documents

Windham Foundation will contribute to your Health Savings Account Monthly.

Full-Time Health Savings Account Contributions

(Paid 100% by Employer)

Click to view HRA Funding 2022

2022 HSA Contribution Limits as set by the IRS

-

Single Coverage Employees: $3,650 Maximum

-

Family Coverage Employees: $7,300 Maximum

*If you are 55 or older, you may contribute an additional catch-up contribution up to $1,000 annually.

The limits include contributions from all sources (employer, employee and any other deposit into the account).

Although employee contributions to HSAs are not required, it cannot be stressed enough how important your contribution is to your ability to pay for your immediate and future medical needs. Every dollar that you contribute to your HSA (up to the IRS limits) is tax free. If you have to pay for medical expenses, what better way to do it than with dollars that would have partially been taxed.

All HSA contributions made by you and by Windham Foundation belong to you, the employee. The account earns interest and will grow, tax free, if left in the account. Under current regulations, any money remaining in an account holder’s HSA upon retirement age (currently 65) can be withdrawn and used for any purpose, the same as a retirement account (withdrawals are taxable as income).

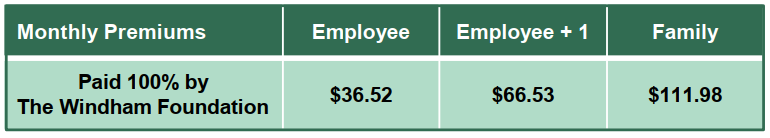

The Windham Foundation offers dental coverage so you and your family can receive the care needed to maintain good health.

Eligibility

All active full-time employees who work at least thirty (30) hours per week are eligible for coverage on the 1st of the month following 60 days of employment. Eligible dependents include spouse and dependent children to age 26.

Contributions

This benefit is 100% paid by The Windham Foundation

Forms and Plan Documents

Other Plan Information

The Windham Foundation offers their employees a Short Term Disability policy that gives a benefit equal to 50% of covered earnings, up to a maximum of $750 per week.

Contributions

These benefits are is 100% paid for by the Windham Foundation.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Contact Information

http://www.reliancestandard.com/home/

Phone: 800-351-7500 (8 am – 7 pm ET weekdays)

Forms

How to File a Claim

There are 3 ways you can file a Short Term Disability Claim. Choose what works best for you.

- Complete the claim form above and mail to Reliance Standard

- Call Reliance Standard at 1-800-351-7500

- Go to www.rsli.com and click “Submit a Claim” under “I am an Employee / Individual“

The Windham Foundation offers their employees a Long Term Disability policy that gives a monthly benefit to an amount equal to 50% of covered earnings, up to a maximum benefit of $5,00 per month.

Contributions

This benefit is 100% paid for by the Windham Foundation.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Contact Information

http://www.reliancestandard.com/home/

Phone: 800-351-7500 (8 am – 7 pm ET weekdays)

Forms

The Windham Foundation offers their employees a Basic Life and Accident Death & Disability coverage that gives their employees a benefit of 2 times earnings, rounded to the next higher $1,000 subject to a maximum of $225,000. For more information on spouse and child coverage please see plan policy.

Contributions

This benefit is 100% paid for by the Windham Foundation.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Contact Information

Forms

Tuition Reimbursement |

The Windham Foundation tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing The Windham Foundations’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will provide up to a $300 bonus to you when you refinance your loans with GradFin. The $300 bonus will be applied to the principal balance of the closed loan.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

Minimum age requirement: In order to participate in the plan, you must be at age 21.

Contact Information

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Plan Information

The Windham Foundation employees have now access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels and much more.

- Save up to 40% on Top Theme Parks Nationwide

- Save up to 60% on Hotels Worldwide

- Save up to 40% on Top Las Vegas & Broadway Show Tickets

- Huge Savings on Disney & Universal Studios Tickets

- Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

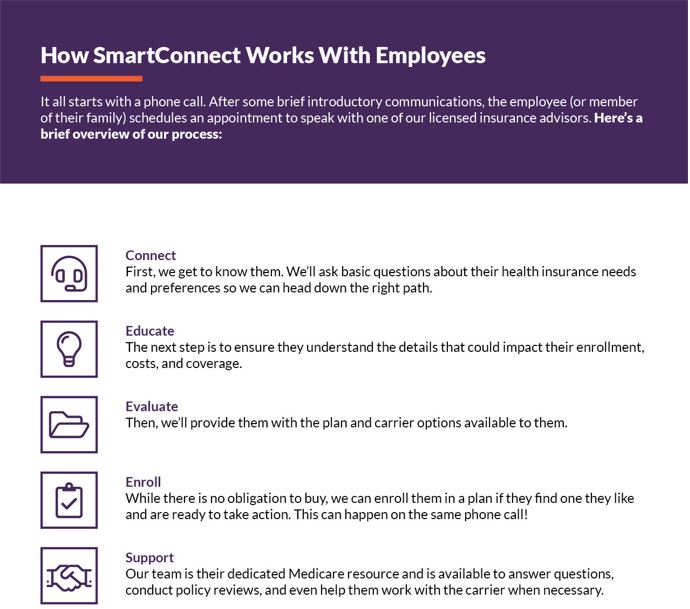

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Upcoming Events

SmartConnect Contact Information

For more information or to get started, please click on the following link:

Additional Information