Eligibility

All active full-time employees who work at least thirty (30) hours per week are eligible for coverage the first day of the month following 60 days.

Eligible dependents include spouse and dependent children to age 26.

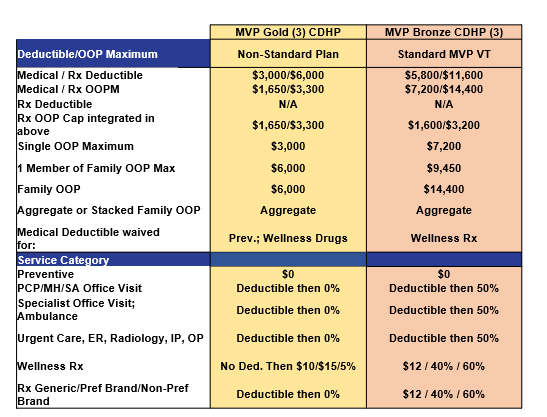

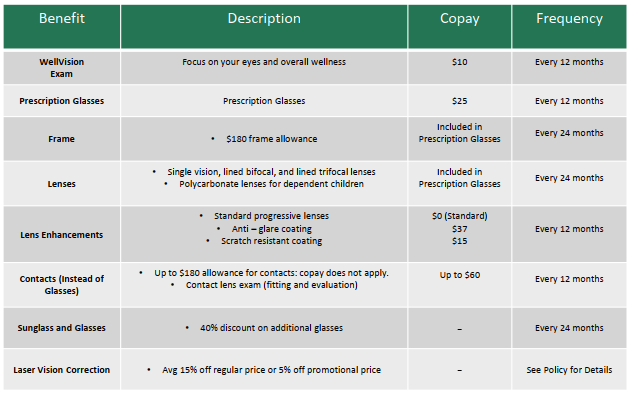

Contributions

Forms and Plan Documents

Gold Plan Members:

MVP will reimburse Gold Plan Members up to $600 per contract, per calendar year, for the things you do to improve your wellbeing.

Click below to learn more!

What is an HSA?

An HSA is an individually owned account that is paired with an HSA-qualified health plan into which an employer and employee may make pre-tax contributions. HSA balances earn tax-free interest and can be used for qualified medical, dental, vision and other expenses now and into the future. See HSA Employee Guide and video to learn more.

2024 HSA Contribution Limits

An employee may elect to make pre-tax HSA contributions through payroll deductions. The combined amount contributed to the HSA by both the employer and employee cannot exceed the IRS annual limit for HSA contributions. The limits include contributions from all sources (employer, employee and any other deposit into the account).

In 2025 the annual combined HSA limits are:

- $4,300 for individuals

- $8,550 for individual with eligible dependents.

Health Savings Account (Gold) funding for 2025:

- $825 for individuals

- $1,650 for individuals with eligible dependents

Health Savings Account (Bronze) funding for 2025:

- $2,900.04 for individuals

- $5,800.08 for individuals with eligible dependents

(Contributions will be divided into equal monthly distributions).

Employees age 55 or older may also make a catch-up contribution up to $1,000 annually.

All HSA contributions made by The Windham Foundation, as well as any contributions you make through payroll deduction, belong to you—the employee. Your HSA account earns interest and will grow, tax free, if left in the account.

To manage your HSA funds, you will need to open a health savings account at a financial institution.

To be HSA-eligible in any given month, an individual must:

- Be covered by a high-deductible health plan on the first day of the month

- Not be covered by other health coverage that is not a HDHP (with certain exceptions)

- Not be enrolled in Medicare; and

- Not be eligible to be claimed as a dependent on another person’s tax return

Plan Information

Click on the 90 second link below to learn more about HSA’s!

The Richards Group has entered into a partnership with Health-E Commerce, also known as the HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

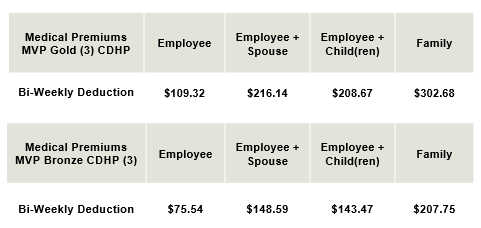

The Windham Foundation offers dental coverage so you and your family can receive the care needed to maintain good health.

Eligibility

All active full-time employees who work at least thirty (30) hours per week are eligible for coverage on the 1st of the month following 60 days of employment. Eligible dependents include spouse and dependent children to age 26.

Contributions

This benefit is 100% paid by The Windham Foundation

Forms and Plan Documents

Other Plan Information

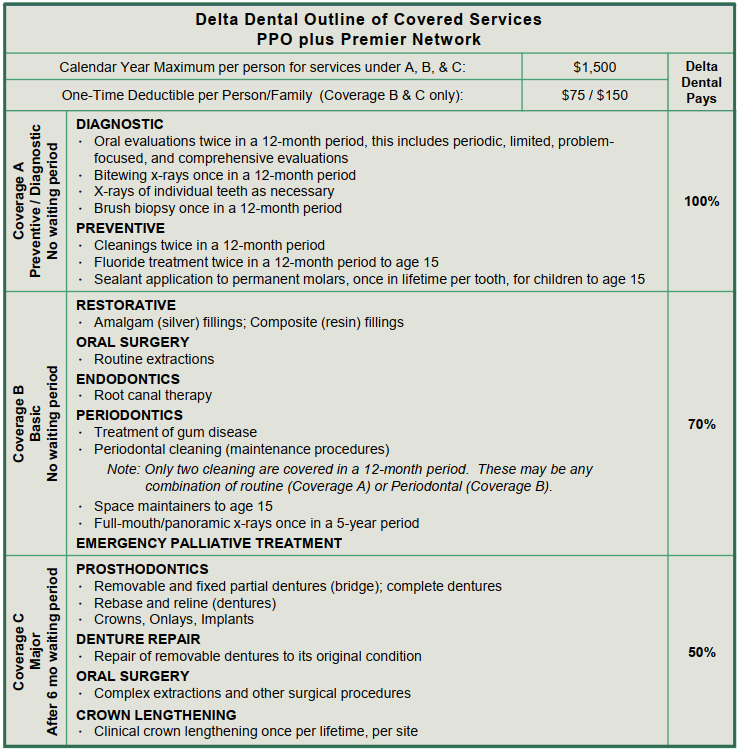

The Windham Foundation is now offering voluntary Vision Coverage so you and your family can receive the care needed to maintain good health.

Eligibility

All active full-time employees who work at least thirty (30) hours per week are eligible for coverage on the 1st of the month following 60 days of employment. Eligible dependents include spouse and dependent children to age 26.

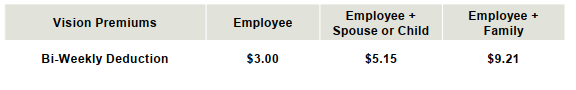

Contributions

Forms and Plan Documents

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

The Windham Foundation offers their employees a Short Term Disability policy that gives a benefit equal to 50% of covered earnings, up to a maximum of $750 per week.

Contributions

These benefits are is 100% paid for by the Windham Foundation.

Contact Information

http://www.reliancestandard.com/home/

Phone: 800-351-7500 (8 am – 7 pm ET weekdays)

Forms/Plan Documents

How to File a Claim

There are 3 ways you can file a Short Term Disability Claim. Choose what works best for you.

- Complete the claim form above and mail to Reliance Standard

- Call Reliance Standard at 1-800-351-7500

- Go to www.rsli.com and click “Submit a Claim” under “I am an Employee / Individual“

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

The Windham Foundation offers their employees a Long Term Disability policy that gives a monthly benefit to an amount equal to 50% of covered earnings, up to a maximum benefit of $5,00 per month.

Contributions

This benefit is 100% paid for by the Windham Foundation.

Contact Information

http://www.reliancestandard.com/home/

Phone: 800-351-7500 (8 am – 7 pm ET weekdays)

Forms

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

The Windham Foundation offers their employees a Basic Life and Accident Death & Disability coverage that gives their employees a benefit of 2 times earnings, rounded to the next higher $1,000 subject to a maximum of $225,000. For more information on spouse and child coverage please see plan policy.

Contributions

This benefit is 100% paid for by the Windham Foundation.

Contact Information

Forms

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

The Windham Foundation offers their employees the opportunity to purchase Critical Illness & Accident Insurnace.

Contributions

This benefit is 100% Employee Paid.

Contact Information

Forms and Plan Documents Coming Soon!

Tuition Reimbursement |

The Windham Foundation tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing The Windham Foundations’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will provide up to a $300 bonus to you when you refinance your loans with GradFin. The $300 bonus will be applied to the principal balance of the closed loan.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

Minimum age requirement: In order to participate in the plan, you must be at age 21.

Retirement |

The Windham Foundation encourages you to save for retirement. To help you prepare, they offer two options.

| Eligibility Requirements |

To contribute out of your own paycheck there are no eligibility requirements.

|

| Employee Contributions |

You may contribute 0 to 100% of your annual pay, not to exceed $23,500 for the 2025 calendar year. If you are at least 50 years old, you can make an additional catch-up contribution of $7,500. Annual limitations are set by the IRS and are subject to change. There are other factors that may further limit your contributions.

|

| Roth Contributions |

Your plan permits Roth after-tax employee contributions as well as pre-tax contributions. You can also elect to contribute a combination of both Roth and pre-tax. These contributions are made via payroll deduction.

|

| Rollovers |

Money from other qualified plans or accounts are accepted if you are a participant in the plan.

|

| Investment Transfers |

Using Empower’s automated telephone or internet service, you have the ability to review your accounts and transfer funds from one investment option to another, 24-hours a day. You can reach Empower at (800) 338-4015 Monday through Friday, and for limited hours on Saturday.

|

| Loan Provision |

Loans are not available.

|

|

|

Eligibility

All full-time and part-time employees are eligible to contribute on Date of Hire

Retirement Plan Contacts

TRG Retirement Plan Consultants

Tracey John

e: helpretire@therichardsgrp.com

p: 802-254-6016

Empower Retirement

401(k) & 403(b) Retirement Plans

Phone: (800) 338-4015

Website: empowermyretirement.com

Plan Information

The Windham Foundation offers an Emergency Loan Program to all Full-Time Qualifying Employees through 802 Credit Union. This is a guaranteed advance of up to $750 to help employees with emergency/unplanned needs, such as car repairs, housing deposits, medical expenses, etc. The proceeds from this emergency loan program are for true one-time emergencies. The advance MUST repaid through automatic payment. The loan will be interest free. To be eligible, employees must be actively employed in good standing with a minimum of one year service or no less than 90 days on the job, in good standing and have a good employment history. Please see Human Resources for more information.

The Windham Foundation employees have now access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels and much more.

- Save up to 40% on Top Theme Parks Nationwide

- Save up to 60% on Hotels Worldwide

- Save up to 40% on Top Las Vegas & Broadway Show Tickets

- Huge Savings on Disney & Universal Studios Tickets

- Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

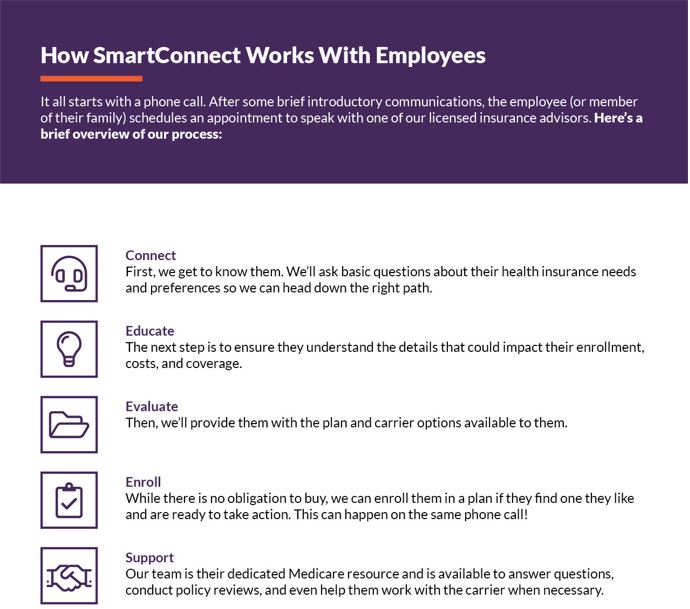

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information:

1-833-502-2747 | TTY: 711

For more information or to get started, please click on the following link:

Additional Information